The specialist retailer dominating lucrative pet medication cat-egory ahead of Pets at Home

At the start of the pandemic, 3.2 million households across the UK bought or adopted a pet and welcomed them into their homes. Pet supplies retailers reaped the benefits and today, they are preparing to maintain and even accelerate their growth, increasing their online presence.

When welcoming new pets with open and loving arms, it comes as no surprise that pet owners want to provide the best care and products for their families’ newest fluffy additions.

The most recent figures published by the Office for National Statistics revealed that expenditure on pets and related products reached an annual value of £7.9 million in 2020, representing a 170% increase since 2005.

However, these new pet owners faced an unexpected challenge at the start of lockdown; with pet stores closed and only having access to the supermarket shelves, options were limited for those who did not shop online.

The closure of stores halved online pet retailers’ competition and those who had an existing online presence were well-placed to capitalise on this soaring demand.

In this blog post, we highlight the key findings on the pet supplies brands dominating their sector for organic search. We cover all the bases including keyword rankings, SERP rankings, link building and page load time.

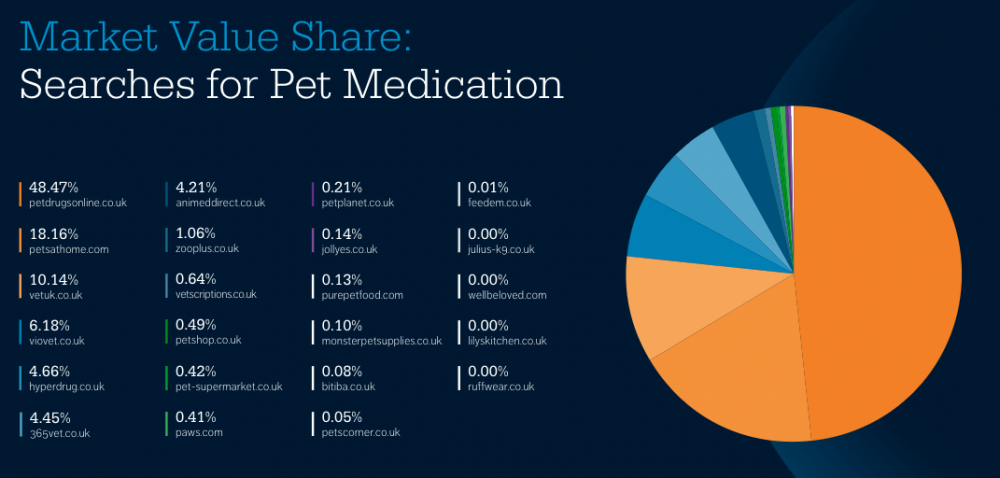

Pet Drugs Online dominates the lucrative medication category ahead of Pets at Home

Our report found that the market value of organic search clicks is worth over £1 million per month in the pet supplies sector.

As you might expect, the larger brands lead the way for highly competitive pet food, dog products, cat products, and medication category terms. Pets at Home leads the market overall taking most of the market share for pet food (36%), cat products (52%), and dog products (63%). You can read our post on how Pets at Home are leading the pack in dog-related terms, here.

The only area in which Pets at Home isn’t the market leader is in the pet medication segment. Instead Pet Drugs Online dominates. Of all of the segments we analysed, pet medication has the highest click market value, worth £576,821 – almost 50% of the total click value of all segments analysed.

The brand dominance is largely down to its well-rounded keyword rankings. The site ranks well for a combination of strong rankings for generic non-brand keywords, and top three rankings for medications by conditions and pharmaceutical brand names.

The site is bolstered by its name too. ‘Pet Drugs Online’ doubles up as a competitive and expensive non-brand phrase that users are genuinely searching for.

Almost 90% of sites analysed could be losing out on valuable SERP space by missing these Schema types

Our report found that no pet supplies website that we analysed utilised Video schema, meaning that there is a lot of untapped potential.

While schema does not have a direct impact on rankings, it does allow you to improve visibility in several ways, including improving the appearance of your search result, which can improve click-through rates.

Despite being one of the biggest players in terms of visibility, Pets at Home does not use any of the types of Schema we analysed. There is a lot of potential to improve their visibility within the SERPs with the use of Schema, otherwise, they may lose clicks to smaller players who do.

Pet supplies sites miss out on topical authority with minimal content that gets links

Our report found that while many pet supplies sites are receiving some good links from product PR, they are mostly from Tier 1 sites. These types of sites are characterised as being some of the top sites in terms of search visibility and audience levels, but they are less topically relevant.

To be the topical authority in any sector, sites must also gain topically relevant links from sites that exist to discuss issues in and around your products and services. They are often a source of inspiration for customers and a trusted website for researching their potential purchases.

Again, Pets at Home was top performing with topical backlinks, securing the most out of any other site. The site’s backlinks came from a mix of product PR, business news and expert commentary. The brand has built the most topical links on animal health sites compared to its competitors.

Other sites are not building topically relevant links by any means, and no sites appear to be creating any successful content marketing campaigns.

Three major pet supplies retailers could be losing out on £1m per month because of their current Page Load Time

In our report, we look at how Page Load Time (PLT) greatly affects the Bounce Rate of each website test.

Ultimately, a slow load time can cause companies to miss out on a significant number of sales from this lost traffic. Even a -1 second reduction in PLT can transform the level of return delivered by people reaching the site through organic search.

Pets at Home stands out from the other brands in more ways than one. The domain has an enormous amount of estimated traffic – 44 million monthly organic visits. The site also has a potential SEO Value of £28 million.

However, when we begin to factor in our research around Page Load Times, we begin to see a truer figure for what Pets at Home could be losing out on – and it totals just over £20 million.

We worked out that by reducing their PLT by -3 seconds, Pets at Home could recoup a staggering £5.7 million every month by holding onto those users that otherwise bounce from the site because of a slow loading experience.

Want to understand more about the search landscape for pet supplies retailers?

Request our latest Search Competitor Insight Report and discover more about the industry, the opportunities, and the winners in the sector, featuring brands like Pets at Home, Lily’s Kitchen, Julius K9 and more.

Click the image below and fill out your details.

Ready to connect?

Please submit your details and as much information as you can about what you would like to discuss:

required information